Here’s how to claim the 30% credit for solar on your income taxes

Disclaimer: While we’re one of the biggest residential solar companies in Central Texas, we’re not tax experts or accountants. Because individual situations may vary, please consult a tax professional before filing for your solar tax credit. This article is a suggestion for claiming the solar tax credit on your income tax filing.

A special solar tax credit is available for Texas home and business owners who install solar panels. Scroll down to learn about applying the tax credit on your upcoming income tax filing.

Note: If you went solar in 2019 you have access to a 30% solar tax credit. If you go solar in 2020 that credit is 26%. The below examples assume you installed solar in 2019 and are filing your current income tax refund.

The good news for Wells Solar customers is that all of your tax filing paperwork is sent to you in a close-out packet, making this process as painless as possible. More on that below!

How does the federal solar tax credit work?

As a credit, you take the amount directly off your tax payment.

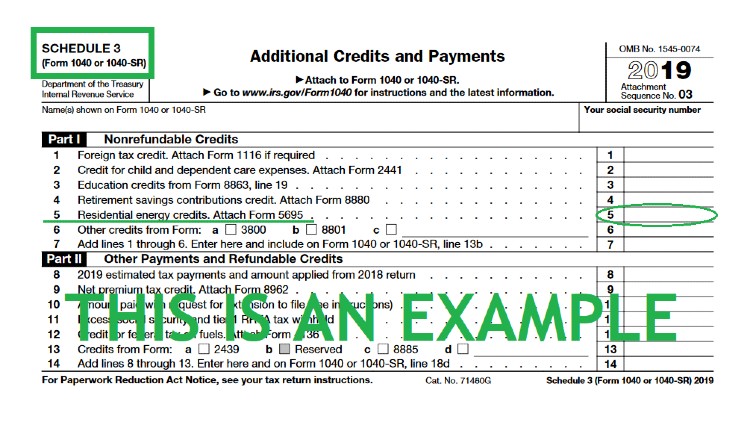

To claim the federal solar tax credit, you must file IRS Form 5695 for Residential Energy Credits as part of your tax return; you first calculate the value of the solar tax credit on that form, and then enter the result on line 5 of Schedule 3.

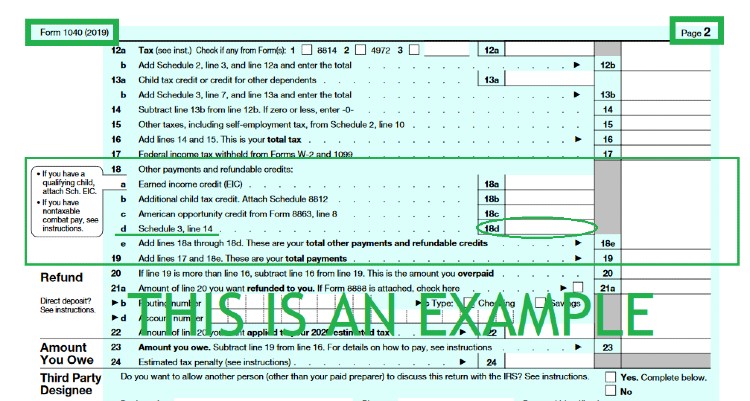

Finally, using the same dollar value from the 2 above steps, input your tax credit amount on line 18d for Form 1040.

If you end up with a bigger credit than you have income tax due, excess credit generally may be carried forward to next tax year.

Please Note: The credit applies to the year in which you go solar. So only if you installed solar panels before December 31, 2019 can you apply for the 30% solar tax credit when you file your 2019 income taxes.

If you haven’t gone solar yet, you can still take advantage of a tax credit for the amount of 26%. Contact Us and schedule your solar savings analysis today! For more information visit the Residential Renewable Energy Tax Credit page.

Current Wells Solar Customers - Read This !!!

As part of the finalization process you were sent a FedEx or USPS box with all of your close-out documentation. When you’re ready to file for your solar tax credit, locate the Wells Solar USB flash drive and open up the ‘New Contract’ file:

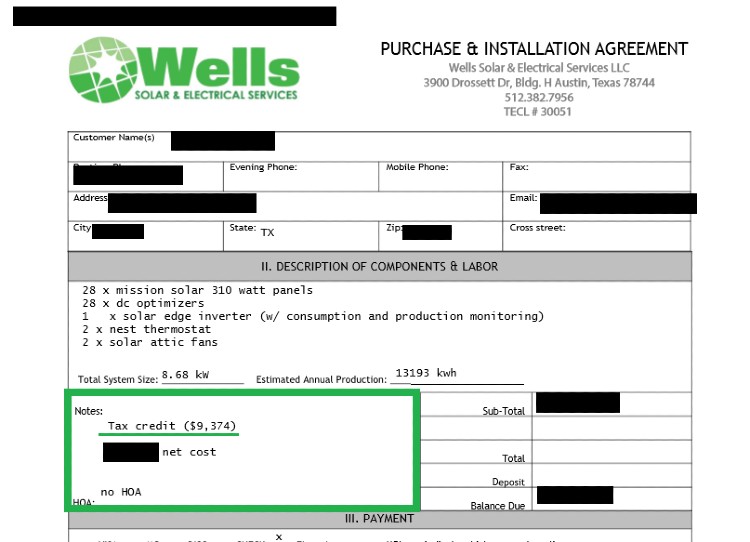

2019 Customers please note, we have included your total system cost as well as your 30% tax credit amount in the Notes section of your Purchase & Installation Agreement.

When filing your income tax return, enter your total system cost on Line 1 of Form 5695, and enter your 30% tax credit amount on line 6. See above images for more detail.

About Wells Solar

Founded in 2014 in Austin, Wells Solar & Electrical Services is a family-owned establishment committed to installing high-quality solar power solutions that everyone can afford. We also offer a full suite of solar panel service, maintenance and repair to ensure your solar investment provides the maximum return over its 25-year life. Find out why Wells Does Solar Better™ by visiting wellssolar.com.